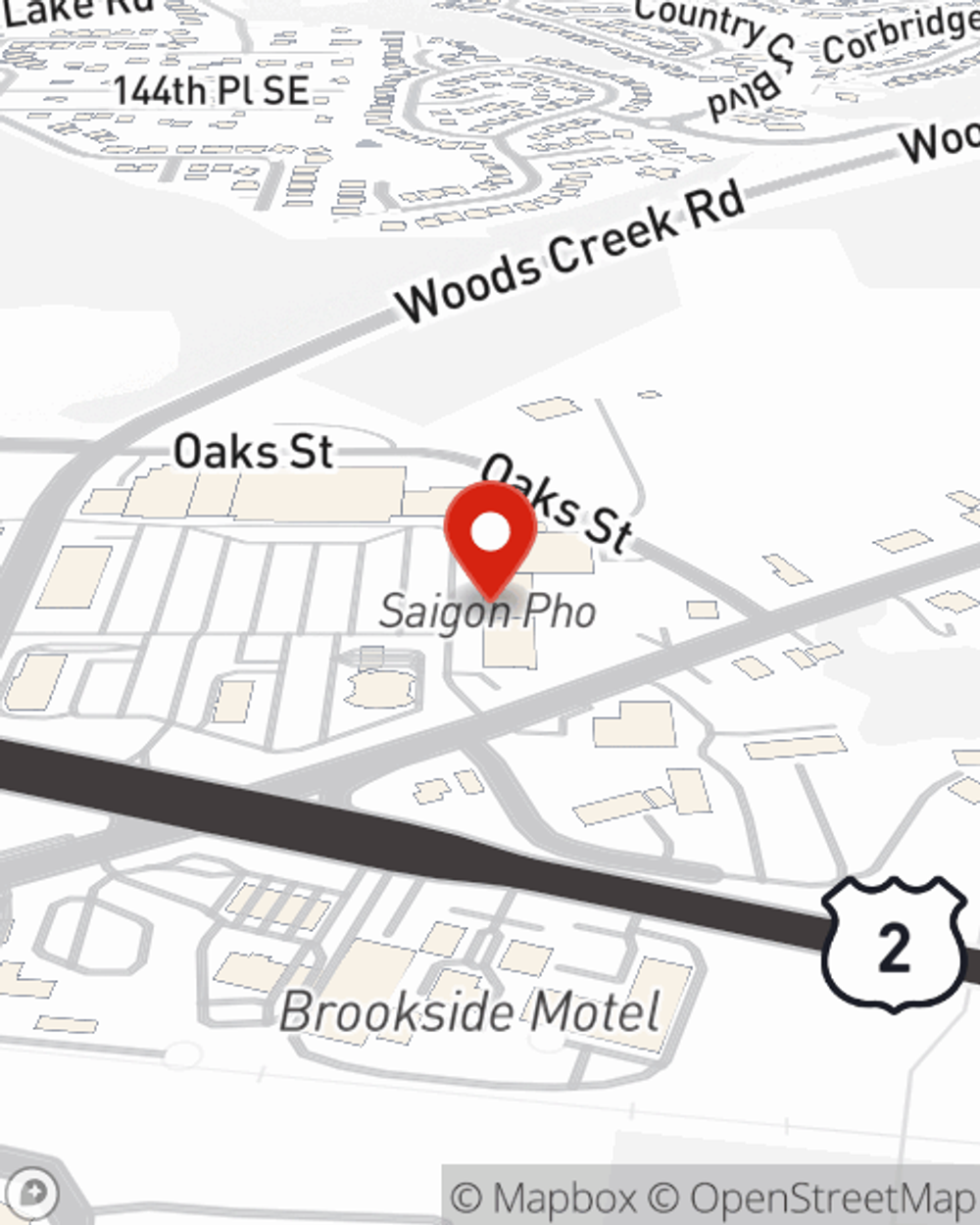

Business Insurance in and around Monroe

Calling all small business owners of Monroe!

Helping insure businesses can be the neighborly thing to do

Business Insurance At A Great Value!

As a small business owner, you understand that sometimes the unanticipated does occur. Unfortunately, sometimes problems like an employee getting hurt can happen on your business's property.

Calling all small business owners of Monroe!

Helping insure businesses can be the neighborly thing to do

Cover Your Business Assets

With options like a surety or fidelity bond, business continuity plans, worker's compensation for your employees, and more, having quality insurance can help you and your small business be prepared. State Farm agent Wayne Britton is here to help you customize your policy and can assist you in submitting a claim when the unexpected does occur.

Curious to research the specific options that may be right for you and your small business? Simply get in touch with State Farm agent Wayne Britton today!

Simple Insights®

Help save trees from the emerald ash borer

Help save trees from the emerald ash borer

This pest can kill your ash trees if given the chance, so learn more about identifying and staving off emerald ash borers.

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.

Wayne Britton

State Farm® Insurance AgentSimple Insights®

Help save trees from the emerald ash borer

Help save trees from the emerald ash borer

This pest can kill your ash trees if given the chance, so learn more about identifying and staving off emerald ash borers.

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.